Disclaimer - Neither I am a financial advisor nor recommending any financial solution. This is plain layman view.

I am back again with a very random post with no linkage to what I do in professional life but certainly one area which always keep me excited. Finance/number crunching it is.

Of late one though kept me bothering how much is enough for future. While philosophical answer will suggest there is no end to what you can call as enough but thinking practically you can probably realize that what you are comfortable with right now will hold good even in future taking everything else as constant. You can certainly think about improving the stature but that is an uphill task where the hill keep on getting changed once you ace it.

Coming back to finance world - corporate finance 101 focus primarily on time value of money. What can be bought with X amount of money might be out of reach with same X amount of money in Y number of years. If this X,Y is troubling just recall the common phrase from your parents/grand parents - hamare jamane mein itne paise mein itni cheeze aa jaati thi (in our time, for this amount I was able to buy so many things). For example - a single lollypop some 10 year back costed may be 0.5 rupee but now probably cost around 2.5 rupee. To put it in simple words, money keeps on loosing value with each passing year and inflation is one to be blamed for that. Historical trend suggests an average 6% (Year-on-year) rate for inflation.

To answer question how much is enough is a tricky task as this number will differ from person to person. For someone like Super cop Singham for whom 6000 Rs/month is enough because his zameer has dum as his necessities are kam (mere zameer mein hain dum kyunki meri zarurate kam) and may be for our great Ambani jee even 6000 lakh Rs/month may not be enough (not because his zameer doesn't have dum but because his necessities and daily expenses are huge to maintain his current life style).

Simple excel calculation can tell you for 6% inflation 1 Rs today will be equivalent to 3.82 Rs at time of retirement age of 58 years, that is after 23 considering your current age of 35 years. That will also mean that you will get to live 24 more year post retirement and the value of 1 Rs will balloon to 15.47 Rs (47 years from now). Considering around 20% margin (I invented this number) over average current life expectancy of 69.93 years in 2021 in India . Why more you ask? Because if you were able to read this far and also intelligent enough to search and plan for retirement then you are above average and that would mean that you will get to live more (unfortunately from financial planning perspective). Moreover, when it comes to averages some number have to be above the average to make up for those numbers which are below average.

Now comes the question how much is enough. If you are a minimalist of age 35 years and able to make ends meet with 20,000/month then multiply 20000 with the column 'Total Corpus needed at time of retirement' to get ideal retirement corpus at time of retirement or 20,000 to 'Present Value of FV corpus (@6%)' to reach amount that you need now (at present time) to stop worrying about retirement corpus completely. Rough calculation suggests that 2.3 Cr s what you require at time of retirement for someone with monthly expense of 20K after 23 years from now. Now doing a reverse engineering with that number will suggest how much you need to save per months to reach that number (roughly 25K/month assuming you have no savings as of now for minimalist person). I am ignoring all other future surprises and commitments like family/child's, your future health expenses, etc for which you should be maintaining separate corpus. If this sounds daunting then you got to relook at your finances and identify ways to either fix your finances or your expenses/lifestyle or probably both.

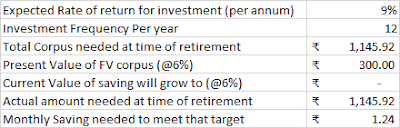

Here goes the calculation which I did for person aged 35 years with monthly expense of 1 Rs/month having 23 years of professional career ahead and probable life of 24 years post retirement. I am also taking liberty to assume growth on future investment as 9% per annum and inflation rate aligned with historical inflation rate of 6% per annum. Choosing a expense number as 1 Rs so that you can multiply it with current expenses to reach your corpus amount. As I have already considered your current saving growth at 6% inflation target you can forget about that part. If you hope to live beyond 82 then too bad! You may have to plan for additional earing avenue or probably cut your expenses. And, luckily if you live lesser then think of this as leaving a legacy for your next generation to act as a seed capital for their startup which you always thought about but never dared to open. After all in my opinion, there is a very thin line between being coward and practical.

What the lower part of calculation suggests is if you have mentioned amount as your current saving in "present value of FV corpus" then you can live peacefully and work only to take care of other commitments. Also, assuming that your current saving will only beat the inflation of 6% and you aren't making any specific effort to grow your capital other than getting into govt/sovereign bond. And finally the calculation for monthly saving you need to meet the retirement corpus target. All can be multiplied with number which you expect to be at your disposal at time of retirement/month.

A very long post but made an attempt just to understand where do I stand. From Gyan perspective, this is what calculation tells us but in real-life there are N number of things can happen and you can't plan for that But planning never harms as it helps to identify the challenges and any future regrets that I wish if I had done this or that. Train will anyways hit you if you aren't able to take any action but at least you will be aware that train will hit you at some point in time and you will be at peace.

Note - I have primarily used FV and PV function in excel to calculate the future value and present value. Used PMT function to calculate the monthly investment needed to meet the retirement corpus goal. In order to keep the calculation I had to make several adjustments but not something difficult to update. Will share the public link of the excel with columns that can be updated to get the actual number. It may not really give the Y-O-Y view but consolidated numbers can certainly be seen.